Computation of foreign investment

To calculate foreign investment, both direct and indirect foreign investment in an Indian company is to be considered.

Direct foreign investment

All investment made by a non-resident entity directly is an Indian company is deemed as direct foreign investment, and the entire amount of such investment is to be counted towards foreign investment when calculating a company’s total foreign investment

Indirect foreign investment

Foreign Direct Investment (FDI) can be made directly in the Indian company, or indirectly through an intermediate Indian company. Investment by an intermediate Indian company (which is owned or controlled by foreigners) into another Indian entity is considered as Indirect Foreign Investment (IFI) or downstream investment. IFI rules apply across all levels of downstream investment. IFI rules are amongst the most complicated rules. With multiple regulators and multiple laws, it has become a complex subject

- If any foreign investment is made by an Indian company, which is owned and controlled by resident citizens and/or Indian companies that are, in turn, owned by resident Indian citizens, such investments would not be deemed as indirect foreign investment for the purpose of calculating the total foreign investment in the target company (in which the downstream foreign investment is being made.)

- If any foreign investment is made by an Indian company that is owned and controlled by non-resident entities, the entire amount of such investment by the Indian company would be the deemed to be indirect foreign investment in the target company (in which the downstream foreign investment is being made.)

- An Indian company would be deemed to be ‘owned’ by Indian citizen and by Indian companies if more than 50 percent of equity interest in the company is beneficially owned by resident Indian citizens and Indian companies that are, in turn, ultimately owned and controlled by resident Indian citizens.

- Control has been defined as the right to appoint the majority of directors or to control management and policy decisions, including by virtue of their shareholding or management rights or shareholders or agreement or voting agreements.

- If any foreign investment is made by a WOS (100 percent subsidiary) of an operating-cum-investing company/investing company, the indirect foreign investment computed with regards to the target company (in which the downstream foreign investment is being made) would be limited to be amount of foreign investment in the operating-cum-investing company/ investing company, i.e., the downstream investment would be mirror image of the holding company.

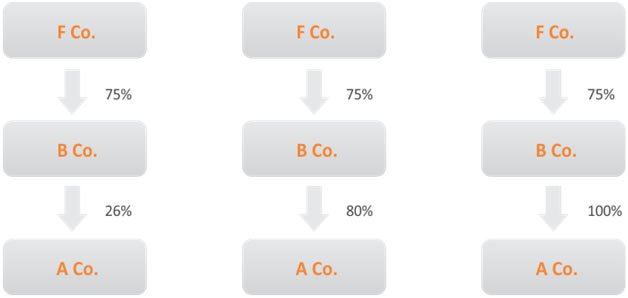

Where company B has foreign investment of says 75 percent and;

- Where company B invests 26 percent in company A, the indirect foreign investment in company A would be taken as 26 percent.

- Where company B invests 80 percent in company A, the indirect foreign investment in company A would be taken as 80 percent.